IDC Report Shows PC Shipments Declined in Q2 2014

PC Rebound in Mature Regions Stabilizes Market, But Falls Short of Overall Growth in the Second Quarter of 2014, According to IDC

FRAMINGHAM, Mass., July 9, 2014 Worldwide PC shipments totaled 74.4 million units in the second quarter of 2014 (2Q14), a year-on-year decline of -1.7%, according to the International Data Corporation (IDC) Worldwide Quarterly PC Tracker. The results reflect the smallest decline in global PC shipments since the second quarter of 2012 when declining shipments of mini notebooks combined with a surge in tablet sales to disrupt the PC market.

Buoyed by both continued business PC replacements and returning consumer interest, the preliminary results for 2Q14 are markedly better than the projected decline of -7.1% for the quarter. Despite the end of Windows XP support in early April, it appears many Windows XP migrations continue to take place. Most major vendors saw solid growth, and early indications also point to desktop shipments being stronger than expected in some areas, signaling continued business buying. The consumer side also appears stronger than expected, with growing activity among the lower-priced models as well as Chromebooks.

On a geographic basis, Europe, the United States, and Canada showed the strongest growth, reflecting more stable conditions. Japan would have joined list but for the dramatic surge last quarter and new taxes that limited second quarter growth. In contrast, emerging regions continue to see declining PC volumes as weaker economies and political issues combine to depress growth.

“The recent strength in mature regions is a positive sign,” said Loren Loverde, Vice President, Worldwide PC Trackers. “However, an important part of this strength is driven by the rebound from weaker demand last year and to potentially short-term replacement activity. We can look for some recovery in emerging regions going forward, but it may coincide with slower growth in mature regions. We do not see the recent gains as a motive to raise the long-term outlook although 2014 growth could get closer to flat, rather than the May projection of -6%.”

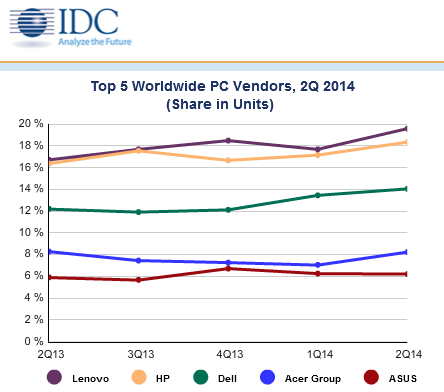

The PC industry remains intensely competitive, with factors such as economy of scale and channel reach continuing to add to the shift toward mobility and new designs in driving market consolidation. While the top 5 PC vendors grew 9.8% year on year in 2Q14, the rest of the market declined -18.5% on the year.

“The better than expected results seem to arise from two places. One encouraging factor was a good intake of lower-end systems, including Chromebooks, which coincides with the recent slowing in tablet growth and perhaps signals the beginning of some stabilization on the consumer side,” said Jay Chou, Senior Research Analyst, Worldwide PC Trackers. “In addition, a sizable number of PCs are still running Windows XP and the impetus to upgrade them continued to boost shipments in the second quarter.”

“In the United States, better alignment with channel partners and internal restructuring helped HP and Dell to grow faster than the market, further consolidating share to 53% between these two leaders. Lenovo and Toshiba also gained share with the highest growth among the top 5 players,” said Rajani Singh, Senior Research Analyst, IDC Personal Computers. “Moving forward, strong sales in the back-to-school season and healthy consumer sales in the holiday season should keep the U.S. PC market in positive territory for the rest of the year.”

Regional Highlights

United States The U.S. market showed strong 6.9% year-on-year growth in the second quarter of 2014. Continuing upgrades of Windows XP systems boosted shipments in commercial portables and desktops, helping the commercial segment. At the same time, retail acceptance of emerging product categories such as Chromebooks and ultraslims helped the consumer segment to stabilize. HP continued to hold the lead and gained 2% market share while four of the top 5 vendors experienced double-digit growth for the quarter. Lenovo and Toshiba took advantage of some consumer interest in Windows 8 and a push to build up their presence in large enterprises.

EMEA The PC market in Europe, the Middle East and Africa (EMEA) posted positive results in the second quarter, with an ongoing push of shipments in the commercial space driving the growth. Renewals, fueled in part by the end of Windows XP support, weighed positively on the market. Demand in the consumer market also improved and shipment levels continued to stabilize, particularly in Western Europe, while emerging markets remained constrained due to weak demand and political instability.

Japan Although the market saw a decline compared to the first quarter of 2014, when the end of support for Windows XP combined with an impending sales tax increase drove last-minute purchases, the second quarter still fared better than forecast, pushing growth just into positive territory.

Asia/Pacific (excluding Japan) A faster than expected deployment of ELCOT deals in India and activity in the entry-level segment helped markets in Asia/Pacific (excluding Japan) squeeze ahead of forecasts. However, shipments were still down nearly double digits year-on-year, marking the ninth consecutive quarter of decline for the region.

Vendor Highlights

Lenovo furthered its lead as the number 1 vendor, showing a strong rebound from a slower first quarter through continued aggressive expansion and pricing strategies. It grew in double digits in nearly all markets, though its home base in Asia/Pacific remained challenging.

HP remained in the number 2 position with growth surpassing 10%, the company’s highest growth since the second quarter of 2010. EMEA and mature markets continued to be sources of growth, as were some last-minute public sector notebook shipments.

Dell shipped nearly 10.5 million units, its highest quarter in more than two years. The vendor has continued to tighten its channel relationships since its privatization and aggressively worked to streamline its operations and relationship with its partners.

Acer continues to diversify its business, with efforts into mobile devices and cloud storage as well as competitively priced PCs. Second quarter PC volume declined -2.5%, which was a marked improvement over recent trends.

ASUS grew 3.3% on the strength of strong shipments of entry and mid-level notebooks. The vendor has also taken steps to capture opportunities created by the sale of Sony’s PC division.

Top 5 Vendors, Worldwide PC Shipments, Second Quarter 2014 (Preliminary) (Shipments are in thousands of units)

Source: IDC Worldwide Quarterly PC Tracker, July 9, 2014

Top 5 Vendors, United States PC Shipments, Second Quarter 2014 (Preliminary) (Shipments are in thousands of units)

Source: IDC Worldwide Quarterly PC Tracker, July 9, 2014

Table Notes:

- Some IDC estimates prior to financial earnings reports.

- Shipments include shipments to distribution channels or end users. OEM sales are counted under the vendor/brand under which they are sold.

- PCs include Desktops, Portables, Ultraslim Notebooks, Chromebooks, and Workstations and do not include handhelds, x86 Servers and Tablets (i.e. iPad, or Tablets with detachable keyboards running either Windows or Android). Data for all vendors are reported for calendar periods.

IDC’s Worldwide Quarterly PC Tracker gathers PC market data in over 80 countries by vendor, form factor, brand, processor brand and speed, sales channel and user segment. The research includes historical and forecast trend analysis as well as price band and installed base data.

About IDC Trackers

IDC Tracker products provide accurate and timely market size, vendor share, and forecasts for hundreds of technology markets from more than 100 countries around the globe. Using proprietary tools and research processes, IDC’s Trackers are updated on a semiannual, quarterly, and monthly basis. Tracker results are delivered to clients in user-friendly excel deliverables and on-line query tools. The IDC Tracker Charts app allows users to view data charts from the most recent IDC Tracker products on their iPhone and iPad.

About IDC

International Data Corporation (IDC) is the premier global provider of market intelligence, advisory services, and events for the information technology, telecommunications, and consumer technology markets. IDC helps IT professionals, business executives, and the investment community to make fact-based decisions on technology purchases and business strategy. More than 1,000 IDC analysts provide global, regional, and local expertise on technology and industry opportunities and trends in over 110 countries. In 2014, IDC celebrates its 50th anniversary of providing strategic insights to help clients achieve their key business objectives. IDC is a subsidiary of IDG, the world’s leading technology media, research, and events company. You can learn more about IDC by visiting www.idc.com.