Intel Q3 Revenue Hits $14.5 Billion – PC Sales Not Diving Off A Cliff!

Intel Reports Third-Quarter Revenue of $14.5 Billion, Net Income of $3.1 Billion

News Highlights:

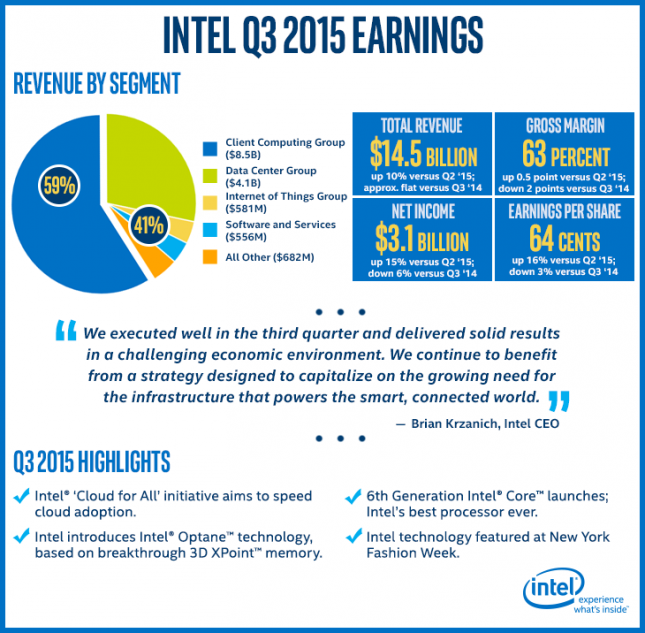

- Quarterly revenue of $14.5 billion, above the midpoint of outlook; gross margin of 63 percent, consistent with outlook

- Quarterly revenue approximately flat year-over-year, with growth in the data center, Internet of things (IoT) and non-volatile memory businesses offsetting lower client revenue

- Results show customer enthusiasm for 6th Gen Intel Core processors

SANTA CLARA, Calif., October 13, 2015 — Intel Corporation today reported third-quarter revenue of $14.5 billion, operating income of $4.2 billion, net income of $3.1 billion and EPS of 64 cents. The company generated approximately $5.7 billion in cash from operations, paid dividends of $1.1 billion, and used $1.0 billion to repurchase 36 million shares of stock.

“We executed well in the third quarter and delivered solid results in a challenging economic environment,” said Brian Krzanich, Intel CEO. “The quarter demonstrates Intel innovation in action. Customers are excited about our new 6th Gen Intel Core processor, and we introduced our breakthrough 3D XPoint technology, the industry’s first new memory category in more than two decades.”

Q3 Key Business Unit Trends

- Client Computing Group revenue of $8.5 billion, up 13 percent sequentially and down 7 percent year-over-year

- Data Center Group revenue of $4.1 billion, up 8 percent sequentially and up 12 percent year-over-year

- Internet of Things Group revenue of $581 million, up 4 percent sequentially and up 10 percent year-over-year

- Software and services operating segments revenue of $556 million, up 4 percent sequentially and flat year-over-year

Business Outlook

Intel’s Business Outlook does not include the potential impact of any business combinations, asset acquisitions, divestitures, strategic investments and other significant transactions that may be completed after October 13.

Q4 2015

- Revenue: $14.8 billion, plus or minus $500 million.

- Gross margin percentage: 62 percent, plus or minus a couple of percentage points.

- R&D plus MG&A spending: approximately $5.0 billion.

- Restructuring charges: approximately $25 million.

- Amortization of acquisition-related intangibles: approximately $70 million.

- Impact of equity investments and interest and other: approximately zero.

- Depreciation: approximately $1.9 billion.

- Tax rate: approximately 25 percent.

- Full-year capital spending: $7.3 billion, plus or minus $500 million.

For additional information regarding Intel’s results and Business Outlook, please see the CFO commentary at:www.intc.com/results.cfm.

Status of Business Outlook

Intel’s Business Outlook is posted on intc.com and may be reiterated in public or private meetings with investors and others. The Business Outlook will be effective through the close of business on December 11 unless earlier updated; except that the Business Outlook for amortization of acquisition-related intangibles, impact of equity investments and interest and other, restructuring charges, and tax rate, will be effective only through the close of business on October 20. Intel’s Quiet Period will start from the close of business on December 11 until publication of the company’s fourth-quarter earnings release, scheduled for January 14. During the Quiet Period, all of the Business Outlook and other forward-looking statements disclosed in the company’s news releases and filings with the SEC should be considered as historical, speaking as of prior to the Quiet Period only and not subject to an update by the company.

About Intel

Intel (NASDAQ: INTC) is a world leader in computing innovation. The company designs and builds the essential technologies that serve as the foundation for the world’s computing devices. As a leader in corporate responsibility and sustainability, Intel also manufactures the world’s first commercially available “conflict-free” microprocessors.